This post was sponsored by COUNTRY Financial® as part of an Influencer Activation for Influence Central and all opinions expressed in my post are my own.

ARENT’ CHORES FUN YOU GUYS??? <——— I said that in the squeakiest, cheeriest voice I could muster…

Are you not convinced?

My kids weren’t either. Which is why I knew I needed to come up with a better way to make chores more fun for them, and help all of us remember that they need doing.

We’ve done charts, and the ‘ol chores-only-happen-when-mom-remembers method. Neither really grooved with our family. We lose the charts 100% of the time and well, let’s just not talk about how often mom remembers chores at an appropriate time.

Now, we’re trying something new. I downloaded the ChorePal app to use with the kids.

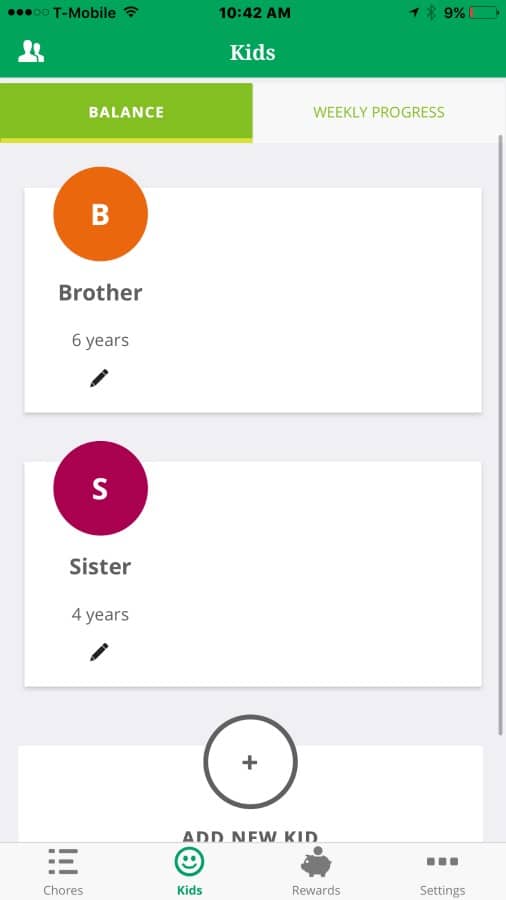

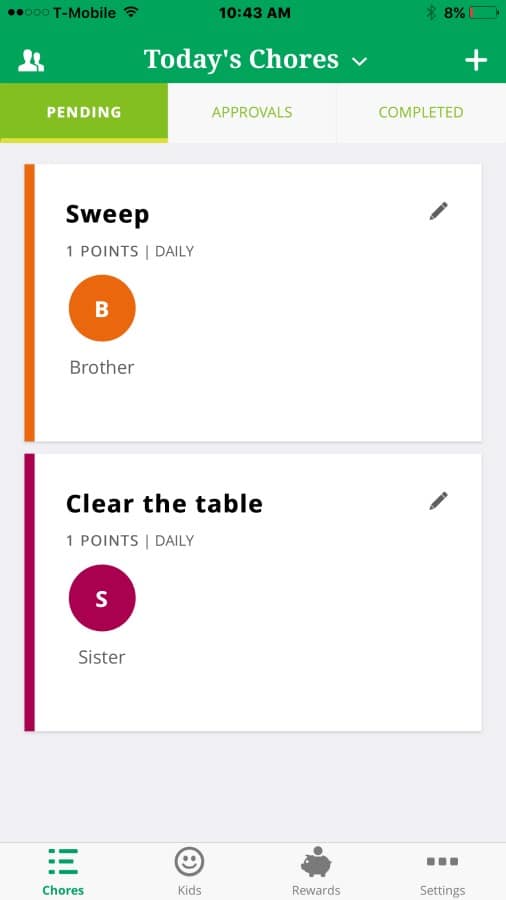

You make little profiles for each child, and then assign chores to them. You’re also able to put how many points or how many dollars they will earn by completing each chore. I love that it gives you the option to use a points system or a dollar system based on what would work best for your family.

The kids are awarded through the app so they can see how much they’ve earned but they are saving it in a digital piggy bank until they are ready to cash out. I LOVE this feature because it really makes them think about whether they want to cash out their dollars for something or not, instead of just spending money because it happened to be in their pocket.

You can encourage them to save for a specific goal they have in mind and help them track it through the app!

It even has badges for the kids to win, so they can compete with each other a bit trying to earn badges first. My kids are definitely competitive and I anticipate a lot of fun being had with that little feature in particular!

I’m excited about this plan because it solves several parenting issues we’ve been having lately.

- It helps us remember to enforce chores

- It opens a dialogue about savings and spending with our kids

- It teaches them that you have to work for what you get

- It teaches delayed gratification, because they don’t see a dollar in their hand right away, they only know it’s coming

These were the lessons my husband and I had to pull from when saving for our house. We went without a lot of things we wanted, in order to buy the house, which we wanted more. We worked really hard. We had conversations about how much we needed to spend in a month and what we should save and we were very disciplined.

When thinking about all the lessons to pass on to a kid, it’s overwhelming to try to know what to tackle first, and how. COUNTRY Financial® ChorePal App is helping us tackle several of these issues all at one time!

A few guidelines to help you stay on track, especially if this is your first time really implementing chores and budgeting with the family.

Don’t do the kid’s chores. Ever. It’s so easy to just run through the house and pick everything up yourself if it’s been a long day, or you flat out forgot to ask the kids to do their chores. We all want a clean house, and I’m certainly guilty of doing my child’s job just to keep her caught up.

This is not teaching a good lesson to the kids though. Instead of teaching them responsibility and the importance of chipping in around the house, it teaches them that if they slack off on their chores, some one else will pick up their slack. I want to raise kids who take initiative and learn to get things done on their own, so I realized I need to stop teaching them the wrong thing by “helping out” when they get behind.

Make a chore time. This is especially important for younger kids. Set them up for success by blocking out a time of day that is specifically for doing chores. This will teach them how to plan ahead to get their responsibilities done, and slowly start helping them to create their own daily schedules so they have time to do everything they want to get done in each day.

Make expectations clear. That’s one of the things that I loved about the COUNTRY Financial® ChorePal App, it maps out clear expectations and timing for kids to know what they need to do on which days. You can mark a chore like “clearing the dinner table” as daily, while making “tidy up the bathroom” a weekly chore for a specific child.

Set up break times. For longer chores, set a timer and let the kids know that when it goes off, they will get a 5 minute break. Larger tasks like cleaning up their rooms can seem overwhelming to a child and this is an easy way to get them to work on it without freaking out at the size of the job in front of them. Our five year old was able to clean his entire room by himself for the first time ever when we started using a timer to give him 5 minute breaks between cleaning sessions. Even our littlest got her bedroom into good shape, following brother’s lead and anticipating those fun rest times.

Model good financial choices About a year ago I realized that, even though my husband and I are very strict budgeters, we weren’t teaching our kids to be. They’d ask for something in the store, and we’d just turn them down, instead of using it as a teachable moment. With this app, I’m looking forward to showing them how to save for it. I’ve also started relating to their desires for things, by showing them we aren’t just turning down their whims. I’ll show my son something I want to purchase in another area of the store, and then explain why that item, along with the toy he wanted, is staying at the store. It’s allowed us to talk about budgeting and smart spending in a way that has my 4 year old regularly using phrases like “not today” or “maybe it will be on clearance”.

Having an area of fun money has been a great part of our budget each year. It helps us control impulse buys because we know it will be coming out of our own share of the fun money we’ve budgeting for that month. It’s also allowed us to save or pool together the fun money to do something we both love but could otherwise not afford. Even when we were barely making ends meet at the beginning of our marriage, we loved taking that debt-free approach to fun nights out.

I’m excited to get started with my kids in this hands-on way to teach them about budgeting, saving and hard work!

COUNTRY Financial® has other feature for mom and dad as well. The COUNTRY Financial® security index measures current sentiments that Americans have about teaching kids about finances through chores and allowance.

COUNTRY Financial® itself is a financial service and full-service insurance company that offers things like retirement planning services, investment management and auto, business, home and life insurance. They are dedicated to helping families in large ways like these, as well as taking the time to help set up kids for success like by launching the COUNTRY Financial® ChorePal app.

Do you give your kids an allowance for doing chores? Share your perspective in the comments!

Nicholas Rabin says

I particularly appreciate your emphasis on the importance of setting financial goals and creating a plan to achieve them – it’s a great reminder to stay focused and disciplined in our financial journey.